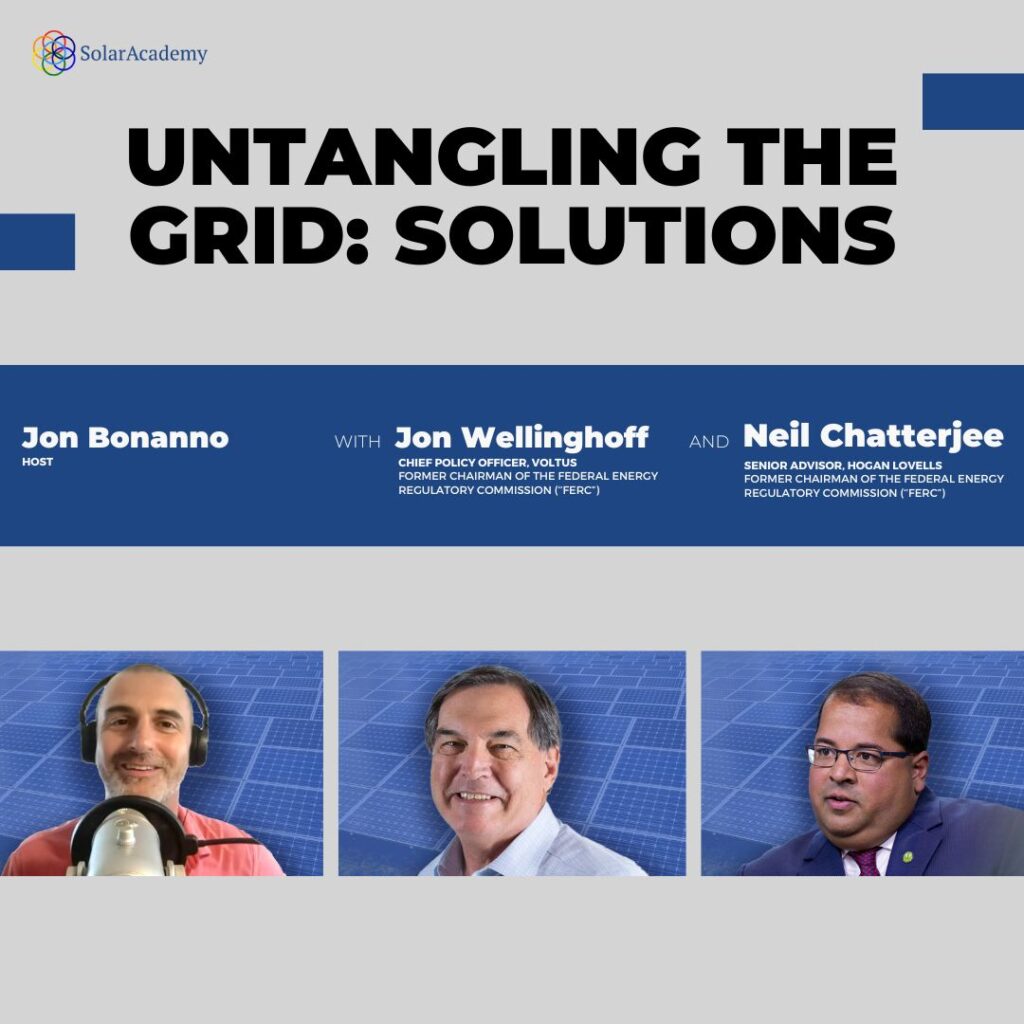

This Solar Conversation follows on the previous two conversations (Untangling the Grid: 101 and Untangling the Grid: 201). In this conversation, Jon Bonanno hosts former FERC Chairmans Jon Wellinghoff and Neil Chatterjee along with Ted Thomas (former Chairman of Arkansas Public Service Commission). The four gentlemen discuss:

- The current state of the US grid as well as the key issues and solutions around the transition to electrification across solar, wind, storage, EVs, DERs, and beyond.

- Incorporation of carbon price into markets, and requiring ISOs under FERC.

- How to prevent anti-competitive practices and advancing IDSOS.

You can find this same Solar Conversation broken into chapters and fully transcribed below.

Challenges and Solutions for Solar, Wind, Energy Storage, and EV Assets (10:10)

Introduce Competition to All Energy Services (Retail, Wholesale, Transmission) (5:12)

Incorporation of Carbon Price into Markets (09:46)

Requiring ISOs under FERC (11:13)

Developing Standard Market Design ("SMD") and Ensuring Effective Implementation of Order 2222 (16:25)

Preventing Anti-competitive Practices and Advancing IDSOS (12:16)

The transcription of the video is below.

Challenges and Solutions for Solar, Wind, Energy Storage, and EV Assets

Jon: Welcome back to another session of Solar Academy and SunCast Media’s Untangling The Grid, which is a fact, or it’s a problem for all of us, that are in this DER decarbonization world, understanding the grid environment here in the United States and how we can lower the cost and increase the speed of deploying the things we want to see. Today is an absolutely incredible session.

Following on the good work of Ted Thomas, that we did in Sessions 101 and 201 around education, of this very unique environment of our transmission and distribution network for electricity in the United States, today we are joined by former chairman of FERC, John Wellinghoff, and also former chairman of FERC, Neil Chatterjee.

Ted Thomas is also joining us. Unfortunately, Neil is en route, somewhere, and Ted is also en route somewhere, especially during these July holiday weekends. And so they’re not able to join by video, but we will hear them throughout the conversation. And I’ll be sure, if it’s not clear, to indicate who is speaking.

Let me get right into it and introduce, Chairman John Wellinghoff, who is a friend, and last time we saw each other was over coffee in the East Bay, which was a real joy. I’m very proud to say that John is a California- born, man, attorney, spent a lot of his life in Nevada, where he’s been working on this energy transition issue for increased renewables, energy efficiency, electrification, and mobility.

Jon himself was the principal author behind the renewable portfolio standards for the great state of Nevada – a very proud moment, I’m sure. First wins, early wins are great ones. John is a longtime advocate of energy customers, and I think we all dare not call them rate payers, although, certain parties do like to call them that.

We like to think about end users that can participate in the energy markets fairly, equally and safely, and demand response. Of course, load flexibility plays a role in that. Jon, under President George W. Bush served as a federal regulatory commissioner, starting in 2006 and into the Obama term, as the FERC chair until 2013. FERC Chair Wellinghoff led on programs and market instruments to support decarbonization of the electrical and mobility systems for all Americans, including the cashback cars concept, which is something we may talk about today, or we may not talk about today, but it’s a very interesting concept that was an early bird of how V2G might work out and how we value that rolling energy storage.

After his work at FERC, Wellinghoff lead, SolarCity and eventually Tesla, but only for a moment, energy policy work. Today, Jon serves along with a good friend of mine, Greg, as the Chief Policy Officer of Voltus, a leading demand flexibility aggregator and market maker.

So that’s the introduction for Mr. Jon Wellinghoff, and thank you very much, Chairman Wellinghoff, for joining us here today.

Also, not on video, but on audio, we have, Chairman Neil Chatterjee. Directly after receiving his JD from the University of Cincinnati in Ohio, Chairman Chatterjee served as Policy Advisor to the US representative Deborah Pryce from Ohio. Then Policy Advisor for – and this is a really awesome one – National Rural Electric Cooperative Association, NRECA, representing 42 million American energy users, across 47 states, being served by not-for-profit cooperative energy providers – super awesome work.

Neil then served, Senator Mitch McConnell from Kentucky as a policy advisor for seven years, and in 2017, Chairman Chatterjee was elected to FERC and served under President Trump, I think, uniquely, twice stepping back to be a commissioner for a minute, and then back to being, the chairman, to complete his term.

He is now a policy advisor, Senior Policy Advisor at Hogan Lovells, a leading law firm and thought leader in the energy space.

Thank you, Chairman Chatterjee, for joining us today.

And finally, but definitely not the least, we have Ted Thomas, who was the Chairman of the Arkansas Public Service Commission, from 2013 to 2022. Ted is a longtime advocate of open access for the electrical network and a strong proponent of solar electricity, as it has become the lowest-cost electron, and it will serve all people. That’s important – I think, something we all share.

Born and raised in Arkansas, Ted led session 201 and 101, previous sessions of this, Untangling The Grid episode, and you’ll see that in the show notes.

As a housekeeping method, we will have the presentation materials that we’re going to show today, in the show notes. We’ll also have any other support materials in the show notes, as we get along here. So I just want to make sure everyone can see this because we’re going to use this as a speaking mechanism for prompting ourselves. This does feel a little bit like a school environment, and that’s sort of some of the point of it. This is, again, a production of Solar Academy and SunCcast Media, focusing on Untangling The Grid. This is session 301, and we are going to be working on the question of – answering the question of – why it is so expensive and time-consuming to interconnect the things that we want to see solar, electricity generation, wind, electricity generation, energy storage, assets, EV charging infrastructure, valuing demand side flexibility, et cetera? Today is a special, episode with Chairman Wellinghoff and Chairman Chatterjee, discussing potential solutions.

There are six components here. Some are reaches, some are immediately possible, and I am going to hand off to Chairman Wellinghoff to lead from this point forward. So thank you, Chairman Wellinghoff.

Jon Wellinghoff: Thank you. Thank you, Jon, and thank you for that wonderful introduction. I appreciate it very much.

Yeah. It’s an issue of why is it so expensive and time-consuming to interconnect these things? And then why is it so difficult to ensure that we can’t accelerate their deployment as well, not only with interconnection, but with utilization by consumers?

There are a number of solutions that I think I threw out there, for everybody to consider. The first category, I think, of those solutions is, if I remember correctly, is that one thing I came to believe in firmly at FERC was that we need to incorporate competition into the system in a much more robust way than we have now.

Here, I’m indicating both of the retail, wholesale and potentially, even at the transmission level. That’s one thing we tried to do, speaking about transmission first, since our question does initially discuss interconnection. That’s one thing we tried to do in Order 1000, when I was at FERC, myself and my fellow colleagues and one of my Republican colleagues at FERC, Commissioner Mark Spitzer was a huge proponent of incorporating competition into Order 1000, and used proponent of eliminating what was called the right of first refusal where, traditionally, incumbent utilities within the states, especially those states with vertically integrated utilities, that were monopoly providers of services, insisted upon having the right to first determine whether or not they could build a transmission project without any competition coming in to bid on that project to determine if it could be done faster or quicker, at a lower cost.

We removed that right from federal law in Order 1000. Unfortunately, the utilities are clawing it back. In fact, I was talking to some people in Kansas this morning where they’re trying to put in a ROFR law there, right of first refusal law there that would contravene the provisions of FERC Order 1000, of course.

And that’s being challenged now in the federal courts. They challenged a similar law in Texas. So, I’m not going on too far here to let my colleague, Neil, step into this, but I believe that we should put as much competition into the development transmission as possible.

Certainly, with the wholesale markets, we’ll talk about that a little later. Wholesale markets should be competitive, and there should be wholesale competitive markets, as broadly as possible. And then even at the retail side, something I tried to do in Nevada, that was unsuccessful. This is something that hasn’t gained a lot of traction yet, but I think it needs to, and that is having consumers have more retail access like they do in Texas, for example, and a number of other states. We need to have consumers have those competitive options.

And with that, Jon, I’ll stop and I’ll turn it over to Neil and let him provide some comments on this issue.

Introduce competition to all energy services (Retail, Wholesale, Transmission)

Neil: Well, thank you both, for having me today. I appreciate the kind introduction, Jon. My apologies for not being on camera. That said, I’ve been told repeatedly that I have a face for podcasts, so I think audio only is just fine.

I think one of the interesting things that my friend, Chairman Wellinghoff noted is that we both have a firm belief in competition and a belief that competition leads to cost discipline, and drives and stimulates innovation.

I think it was a hallmark of both of our 10 years at FERC that we focused on competition. And it’s interesting, he was appointed by a Democrat president. I was appointed by a Republican president, but in many ways, our legacies, the commission are intertwined because a lot of the work that I did during my tenure at FERC, that I’m most proud of, quite frankly, built on the work that Chairman Wellinghoff started.

It was really through this kind of consistent view that competition will enable us to really and truly extract all of the benefits and the excitement of new energy transition. And the framework for this discussion today is around the challenges, the costs and the obstacles to getting more renewables, more solar and more wind, more storage connected to the grid.

But I tend to view this through a more positive lens. But this is actually an exciting opportunity, and yes, there will be obstacles to getting there, but the fact that we were even having this conversation, to me, is an indicator that advancements that we’ve had, particularly when it comes to technological innovation and some of the market reform to enable that innovation to be compensated and to thrive, has put us in a very exciting place.

And where I would love to kind of focus the discussion today is around some of those market rule changes that I got to work on, that built on what Chairman Wellinghoff started. Two of the orders that I’m proudest of, FERC Order 841 and FERC Order 2222, removing barriers to entry for energy storage and aggregated distributed energy resources.

These are predicated on the notion of competition and opening up markets to enable these new technologies to thrive and to be compensated for all of their attributes, for capacity, for energy servicing. I think working together, we can all embrace and overcome some of the obstacles that we certainly face.

The interconnection process is an issue. We can talk about the future of markets and competition and what the current policy and political outlook is. There are opportunities and headwinds in front of us, but I appreciate the opportunities to discuss them today. It’s great to be here with esteemed folks like Chairman Wellinghoff and my friend, Ted Thomas, as well.

Jon: Thank you, Chairman Chatterjee. A great, great place to start is with competition. And Jon, I think you’ve raised a very good point, as we’re not just talking about access to a network. We’re talking about fairly valuing the operation of these assets in a network. I think I probably failed in posing the question because it’s not just interconnecting these assets. It’s really having the true value of these assets be realized.

That is not always possible, if you’re being punitive on the rate structure or on the interconnection or whatever it might be, but I think I might want to revise my own question around this. It’s not just access. It’s fair value of operation, and it’s a great point that you both make about competition of these assets one to the next.

Sadly, Jon’s citing something here in Kansas, as of this morning, seems to be an incumbent, looking again to usurp or take advantage of their position and not have a competitive process around transmission. But, hopefully, that will get resolved, and we will move forward.

A great place to start is on competition. I think we all recognize that solar electrons and wind electrons are, if not today, moving very quickly towards the lowest cost electrons. Pairing them with energy storage makes them a superior asset as to coal or natural gas. So, really, we’re in a very, very different place than when Chairman Wellinghoff started his tenure at the commission.

Incorporation of Carbon Price into Markets

Jon, can I ask you to lead the second point here, incorporation of carbon markets?

Jon Wellinghoff: I will, and I’m thinking talking about valuation and right now, the fact that under the current market structures, solar and wind are the cheapest assets on the grid. But imagine, if markets were actually fair because markets are not fair. Because we’re not incorporating into those markets a very, very important cost, and that is the cost of carbon. We’re not incorporating into those markets what the value is to consumers of having lower, no carbon resources incorporated into those markets so that we don’t continue to have serious climactic events where we’re experiencing, certainly in the West here where I am in Nevada currently and in California, the horrific situations they’ve seen there with the wildfires. And I know, throughout the East now, is starting to get their dose of it from the Canadian wildfires, as well.

This is only going to get worse and worse. We all know that, that the papers have just had reported recently that this 4th of July was at the hottest day on earth we’ve ever, ever seen, as average temperature across the entire planet.

Jon: Having been doing this work for, as you know 22 years, like you have Jon, the science has been pretty reputable throughout this entire journey, and sadly, we’re living in the existence of this science.

Externalizing the cost of your generation seems to be something that many of the fossil combustors have been allowed to get away with, but your second suggestion here in solutions is around actually internalizing that cost, which would make solar and wind even more competitive.

Jon Wellinghoff: Absolutely and that’s why I would like to be an optimist like my friend, Neil Chatterjee. I hope we can be optimistic, but I think to actualize that optimism, we really have to get realistic about, what are the prices and costs to society of these things that are not now, internalized, but are externalized? That’s why I put incorporating the price of carbon into markets as the second critical feature here.

Jon: Jon, in your modeling, a very quick question for you, Jon, and maybe to Neil, as well, when we discuss a carbon market, obviously, we’ve seen Europe try and stop and try and stop around getting the right price and allocation of allowances, et cetera. In your mind, what’s the starting point? Is it $50 a ton? Is it $100 a ton? Where do we start? Or do we just start a buyer-seller market and go for it?

Jon Wellinghoff: I’ve read a number of academic treatises on this, and some people suggest we, perhaps, should start at a very high price, several hundred dollars a ton, and if necessary, then work backwards, work down to a lower price as more and more low carbon resources get into the system, ultimately, and drives out these fossil fuel-based resources.

I don’t think it would take that long if we did incorporate a fairly high price, $80, $100 a ton plus into the system to drive out the remaining fossil fuel resources. And certainly, they’re already being driven out by the current low prices.

Jon: Yeah, and I also think that the financial markets are catching up here, where you’re seeing these new resources that are requiring fossil inputs are not getting financed because the forward curve just doesn’t support these types of assets in the long term, especially if we’re pairing with storage a solar or wind asset, and the cost is still lower than natural gas on peak. You’re going to see that financing problem.

But let’s move over to Neil here for a minute. And Chairman Wellinghoff is suggesting maybe some data suggest, we should start at a very high price for the carbon ton and then Dutch auction down, or in some mechanism, move it down. What’s your thinking about incorporating the cost of emissions and pollutions upon our society, into someone that’s creating those emissions?

Neil: Yeah. This is something that was central to my tenure at FERC, and in the eyes of some, led to my being fired as Chair of the Commission, by former President Trump.

But what I dealt with during my tenure was a scenario in which we really struggled with trying to balance state decarbonization goals with the efficient function of markets. And what we found was in the absence of federal legislative guidance, specifically on carbon mitigation and decarbonization, increasingly, states were taking it upon themselves to pursue their own policies to achieve their carbon reduction goals. And those policies, when you were dealing with multi-state markets, were distorting efficient market signals. It put the commission, quite frankly, in an impossible situation. The largest market PJM in the Mid-Atlantic, came to FERC and essentially said that the status quo is unsustainable and that FERC had to take steps to amend PJM’s tariffs to accommodate for the challenge of balancing these state policies with efficient market function.

And what the commission did under my tenure, that was not an easy decision, but we implemented something called a minimum offer price rule, that it’s an oversimplification, basically required bidders into a forward capacity auction to bid their true costs, not their subsidized costs. And that in turn, led us to a situation where a number of generators and states contemplated exiting the competitive wholesale power markets.

That put me in a really challenging position as someone who believes in markets, who believes that markets have delivered tremendous benefits for consumers, for the economy, and for the environment. We’ve been successfully squeezing carbon out of the US power sector due to, in my belief, the contributions of competitive wholesale power markets.

And so I wanted the power markets to succeed and to continue. And I was faced with this conundrum where the market protective step that the commission took, the MOPR, was leading people to potentially exit the market, and sort of led to the dissolution of the markets, which was also not an acceptable outcome.

And I found myself in this impossible situation. And after much research, study, analysis, and talking to the foremost experts on the planet, came to the conclusion that a transparent price on carbon was the most effective way to enable that balance to occur, to enable states that wanted to meet their decarbonization goals to do so, while still providing accurate market signals.

Now, I take a little bit of a different viewpoint on this than Chairman Wellinghoff in that I didn’t want to put FERC in the position of using its powerful authority under section 206 to impose a price on carbon and potentially set that price. My approach was to enable the markets, enable an RTO or an ISO or a state that wish to incorporate price on carbon to come up to the commission via the section 205 process, but to create a legal basis to make clear that FERC could make a determination on whether such a tariff amendment were just and reasonable.

And I understand that that may not be as aggressive as some would like to see. But I was trying to also balance the political realities around the fact that a price on carbon is tough because when the economy’s performing well and strongly, energy tends to be at the core of that successful economic performance.

And people are loathed to do anything to disrupt that successful economic performance, like adding a price to energy. When the economy is struggling and people are hurting, energy prices tend to be sensitive, and policy makers are loathed to add an additional cost in that time. So there’s never a good time, politically, to talk about a price on carbon, unfortunately.

It doesn’t mean that it’s not the right policy to pursue. I simply thought that enabling an RTO or ISO to work its own stakeholder process and come up with a price on carbon that FERC could make a thumbs up or thumbs down call on, was a step in the right direction.

Requiring ISOs under FERC

Jon: Thank you very much for those thoughts around emissions and incorporating that into price of things. Two different ideas here, one put forward by Chairman Wellinghoff of a FERC-mandated carbon market, and then we have a second suggestion of an RTO/ISO based pricing signal from Chairman Chatterjee and both having their merits and both having their detractions. Interestingly, and it’s no secret to anyone that the people that have the least voice, low and medium income people are typically the ones that suffer the greatest consequence of emissions.

My personal view is we need it fast, and we need it to be actually market-moving and whichever mechanism gets us there faster, would be appropriate. Sadly, I think that we’ve toiled long enough on the emissions price, and we’ve gotten very little progress – so whichever way goes faster.

Jon, I’m going to ask you to introduce the third solution here, which is, another great one.

Jon Wellinghoff: Well, and it’s a subset of the first one of making all energy services competitive. And if we’re going to make them competitive, then we need to ensure, at least at the wholesale market level that those independently-operated and overseen competitive wholesale markets are everywhere in the United States, and right now, they’re only in certain regions, throughout the Southeast, all of Florida, most of Mississippi, Alabama, Georgia, the Carolinas. There is no independent wholesale market, whatsoever. Also, in the western United States, with the exception of California, west of the Rockies, there’s not a full robust market, although they’re moving in that direction. I really believed when I was at FERC and we were trying to move markets into the Southeast and into the West, it would’ve happened by now. I mean, that was 10 years ago when I left FERC.

It’s been a very slow process, and as Neil indicated when we were talking about carbon prices, I mean, it always is a balance about how much authority FERC has to push these things forward versus the authority given by Congress. If you don’t have the explicit authority by Congress, you always are on the knife edge of, if FERC acts, whether or not that’s going to be appealed and struck down by the courts because you don’t have the sufficient congressional authority to move forward.

I know my good friend, former Chairman Pat Wood, who was the Chair of FERC, two commissions before me, this was his idea, really not mine, to put ISOs and wholesale markets everywhere throughout the United States. And he moved aggressively to do that and was told in no uncertain terms by the White House that if he continued to do it, that Congress would likely reverse it. So he stopped, unfortunately.

Jon: But yet, Jon, we have an FAA. We have a group that regulates the airwaves. We have marine federal protections. We have highways, railroads, telecoms. These are all non-balkanized, independent operations as in energy. Why is it impossible today? And maybe this is a question we can have both of you answer. Why is it so impossible today? Is it because of the very wealthy incumbents that have a vested interest in holding down their little region as chiefs? Or is there another reason that I don’t understand why we can’t have a federal regulator that deals with the entirety of the United States as one unit?

Jon Wellinghoff: Well, in my opinion, I think, Jon, you’re right. It’s primarily because there are very powerful incumbent monopoly interests in these regions, that wish to retain those monopolies in the west that’s breaking up. We now have the states of Nevada and Colorado.

Both of those states, their legislatures have voted to require that their utilities go into an ISO/RTO, that there be an independent wholesale market that those utilities join. So the states and the people in those states are understanding that there are tremendous financial benefits to consumers by having this competitive, open wholesale process, available to consumers and to the utilities that are doing business in those areas that will drive down prices for everyone.

So, that’s starting to break. It’s starting to open up. It’s just so glacially slow that it’s very, very maddening and frustrating for me to see.

Jon: But you’ve also mentioned a massive part of the United States, the Southeast that has no ISO at the moment, and could potentially be joining a federal agency.

And let me turn it over to Neil now to get his view on a FERC that had real jurisdiction over the entirety of the United States around energy at large.

Neil: Yeah, look. I’m from the Southeast. I’m from Kentucky. I was encouraged lately, to see that even the Southeast is expressing a willingness to at least explore moving towards a market.

They acted on a SEEM proposal, the Southeast market proposal. That didn’t go as far as I would have wished for it to go, but it is at least a step in the right direction towards potentially creating a market in the Southeast. I think that effort, coupled with some of the efforts I’ve seen out West are very encouraging to me.

That said, I think there are huge obstacles that we need to be cognizant of. For whatever reason, we are finding ourselves in a position, in 2023, into which there seems to be a growing animus towards the existing market constructs and in a strange way, could be a pulling back away from markets, particularly capacity markets.

What I think we’re seeing is that, and I don’t like to speak for anyone else, and so these are just my observations of what may or may not be some of your views of the current commissioners on FERC, but some of the conservative commissioners sort of feel that in the absence of a hardcore MOPR, which I described earlier, that the markets aren’t working, and we should take a step back towards, traditional, vertically integrated utility models with cost of service recovery, which I think would be a setback for consumers, for the economy and for the environment.

But you also have some of the more progressive commissioners who I think view capacity payments in particular, as offering a lifeline to otherwise non-economic fossil generators, probably peaker plants, and that coming together of minds, on folks from opposite viewpoints – concerns, because I don’t want to see the United States take a step away from markets.

I would much rather us move towards greater market expansion. And then, the final point on this, and Chairman Wellinghoff alluded to it, about FERC’s power and what FERC could do in this regard. And there are some people who have asked, why isn’t FERC more assertive in using its power to force market expansion?

And the reason there, and this is kind of interesting for your listeners, as you educate them on how these things come about, I don’t think this was by any sort of design. I think it was just a total fluke of history and politics. But the Senate Energy and Natural Resources Committee of the United States Senate is the committee that has primary jurisdiction and oversight of FERC.

So all future and current FERC commissioners who wish to seek another term have to go before that committee in the United States Senate. If you look at the roster of the Senate Energy and Natural Resources Committee, by total fluke, most of the senators come from non-competitive states, from states that aren’t participants in wholesale competitive markets.

And some of them are resistant to having such markets forced upon them. And so it’s really hard for an interested nominee to go before the Senate Energy Committee and talk about potentially using FERC authority to impose a market on a region that might be resistant to it. So there are all of these factors that are potential headwinds to market expansion in the country.

And it’s frustrating in a time where I think, we’re seeing the benefits of markets more than ever. I hope that we can overcome this brief period where there seems to be some skepticism, frustration of markets and move back towards abrasive markets. But we’re in a perilous time, right now.

Jon: Those are great observations and sort of an inside baseball view of how the sausage is made with the Senate Committee. And maybe listeners, if they’re interested in having a FERC that has jurisdiction over the entire United States, one should advocate with their representatives in Washington, to have folks on that committee, based on how they’re assigned to be more supportive of this stuff.

So, a good inside baseball view, Chairman Chatterjee. Thank you for that. And we’re going to go ahead here, just in the spirit of keeping on time. One of the ones that has been cited is a very difficult one, but I really don’t like to hear Chairman Wellinghoff say, it’s been 10 years, and we’ve made very little progress, as we did on that last subject.

I mean, we really have to start charging forward faster in my mind,

Developing Standard Market Design (“SMD”) and Ensuring Effective Implementation of Order 2222

but let’s get onto the hard one, the SDM, which is standard market design.

Jon Wellinghoff: Yeah, we’ve made no progress on this one. As Chairman Chatterjee alluded to, with respect to capacity market issues and some of the reversals with the some of the more conservative members of FERC, but as Chairman Chatterjee said, we are seeing somewhat of a retrenchment on the issue of certain market structures, and this idea of standard market design just for me to say that, again, this was another concept by my friend, former Chairman Pat Wood, who wanted to not only expand markets throughout the United States, but believed that the structure of those markets should be the same everywhere.

Here’s the concept that I think is really important for competition. If I’m a merchant generator, and I want to do business in Maine or Massachusetts, in ISO New England, and I have a market structure there, my market structure there should be no different than my market structure should be in California or in Texas. Well, Texas, obviously, is outside of FERC’s jurisdiction, but that’s another whole issue we can get into. Or maybe that’s another whole program. But in any case, the way that the market runs for a generator, a solar system provider, a wind farm, or even fossil fuel generator, the way the market treats that generator and the way that it compensates that generator should be in a consistent manner.

Certainly prices will be different because of congestion and regional variances in load and other issues, but the basic market rules, the market design should be the same. And not only for the generation side, but for the demand side, as well, that we’re going to get into in a bit here, when we start talking about Order 2222 and IDSOs and some of these other things. Ultimately, all of the demand side providers that have distributed energy resources, should be treated the same and be under the same market rules, everywhere. We shouldn’t have to have a different rule for metering and verification in PJM as we do in MISO , as we do in California and CAISO because if you have to operate under multiple different rules, it’s very difficult then as a competitive provider to ultimately access those markets. It is a barrier to market access to not having standard market design throughout the country.

Jon: And scaling.

Jon Wellinghoff: And scaling. Exactly. And scaling these things as well. Yeah. With that said, this is a very difficult, difficult thing to do because of, in part, the fact that these market rules are largely a product of the stakeholder processes in each one of these individual market regions.

And those stakeholders are, in many instances, dominated by the incumbents within those regions who want to preserve their structures and rules for their incumbent resources, whether it be generation or other resources in the area. So, as a result, we have had very little traction. We are seeing, all kinds of retrenchment with things with respect to capacity markets.

And I’m not necessarily a total fan of the capacity markets. I think that there does need to be certainly some provision for resource adequacy in some way. California does it one way. Certainly, PJM does it in a much different way. Texas is struggling with it, as well, in their market design.

But it needs to be done in some way. But I think once we decide what is the best way, the most efficient way to do it, it needs to be uniform. And those uniform rules need to be incorporated into markets, throughout the country.

Jon: Those are great statements.

Neil, let me move to you now. Is it a requirement to have a unified FERC in order to have SDM work correctly?

Neil: I think it’s more than a unified FERC. I think it’s a unified industry, and I think therein lies the challenge. Even just reforms to the stakeholder process, this is something that I think has come on the radar of Congress and other FERC overseers who believe that there are genuine structural changes that could be made within the RTO/ISO stakeholder process.

And they’re hopeful that FERC could use its administrative strength to try and compel changes to the stakeholder process. But what I have found is that the differences in different regions are such that a one size fits all, sort of stakeholder reform approach, I think, would struggle because the challenges and obstacles that exist in PJM are different than those that exist in CAISO or in MISO or in New England.

And so I think therein lies an additional challenge to SMD is that the different regions have kind of evolved in different ways to where, yes, you are seeing some similarities across the regions, but there are also some substantial differences. And so trying, I think today, to force a one size fits all approach, I do think would be met with considerable resistance, and therein lies the biggest challenge.

Jon: Got it. Now, as the champion of 2222, Neil, I’m going to let you introduce this next solution, which is a fully and fairly implemented Order 2222. I know that some of these ideas originated under prior leadership, but you were the one to get it over the line, I believe, if my information is correct. Talk us through a little bit about fully and fairly implementing Order 2022 would do for this solution set.

Neil: Yeah. I would say FERC Order 2222 is amongst my proudest achievements at the commission. And I couldn’t have done it without some of the intellectual thought leadership of my predecessors, including former Chairman Norman Bay, and as well as Chairman Wellinghoff.

When I first came to the commission, I had had a couple of senators who put a hold on my confirmation. Senator Sheldon Whitehouse of Rhode Island, Senator Ed Markey of Massachusetts, they objected to my confirmation, and they brought me in and they said, look, we understand, at the time that I was going through the process, FERC had lost a quorum for a period of about seven months. And there was a lot of pressure to get the quorum restored and get FERC back to work, in order to address a significant backlog in pipeline certificate applications that had begun to accrue at the commission.

And what Senators Markey and Whitehouse said was, we understand there’s going to be a lot of pressure when you take the job from within stakeholders and the commission to start acting on these pipelines.

But FERC has begun a process of evaluating or moving barriers to entry, to energy storage and to aggregated distributed energy resources. And we simply, we don’t want you to promise an outcome one way or the other, but just take a look at it and study the docket and see what you think. And I made that commitment. And once I took my seat at the commission, I fulfilled the promise I made to a couple of United States senators.

And I started to dig into the issues. And what I quickly realized was there was real opportunity here, and someone who believes in innovation and opportunity, this could be transformative. What I quickly saw was that we were way further along on energy storage and there were some complicated, behind the meter issues regarding DERs that would take longer to sort out.

And so I broke apart the two rules into separate rules. The first was FERC Order 841 on storage, and it wound up being a master stroke that I didn’t even realize at the time because we learned from the 841 implementation process. And then, ultimately, also, we’re backed up by the D.C. Circuit, which upheld the commission’s approach, on a challenge by EEI, NRECA, APPA, and NARUC, and that put us on stronger legal footing to move forward with ultimately what was FERC Order 2222. And I was really excited about 2222. When I think about DERs, I think about electric vehicles, rooftop solar, advanced appliances, technologies that hide in plain sight, but have tremendous power.

And the idea behind 2222 was really that if you are a single EV owner, your ability to impact the power market is nil. But through the power of innovation and aggregation, you can harness thousands upon thousands of EVs. Suddenly, you’re competing against the power plant down the street, and you’re doing it at the point of demand.

And I really believe that if properly implemented FERC Order 2222, we may look back and say it was the single most significant action the agency could have taken to address carbon mitigation and to really fundamentally alter the way that Americans generate, distribute, and consume power.

And the really exciting thing about it, if you just want to focus narrowly on the EV angle, is that if this power sector rule actually leads to the accelerated deployments of electric vehicles, then not only are you mitigating carbon emissions in the power sector, but also are contributing to emissions reductions in the automotive sector, which is a far greater source of emissions in the US.

So it’s really, really exciting with a big but. And the but is in that compliance and implementation process. And what we’re seeing is some resistance in some of the regions because this is new and because this is complicated. And you have one region in particular, which says that they cannot possibly comply with the obligations of FERC Order 2222, before 2030, at the earliest, which I just think is absurd.

And I said it at the time and I continue to believe it today, the difference between 2222 being an effective rule and a historically transformative one, will come down to the compliance and implementation process. And I have no doubt that because of the complexity, because of the change associated with the rule, there will be resistance across the regions.

But it’s really important that stakeholders step up. And one of the reasons I was motivated to do this program today was to encourage people that don’t typically engage with FERC or engage with the RTOs and the ISOs, to not be intimidated, to make sure that their voices are heard and to work with other stakeholders to make sure that we get all of the benefits and take advantage of the potential that this rulemaking has to offer.

Jon: That was a great setup, and I really appreciate it. I’m going to ask you a couple of questions, Chairman Chatterjee, about today’s Senate makeup of that committee, to which the FERC commissioners report. We’re going to need to call some people out. So after this, you and I are going to make a list, and then we’re going to have people calling those offices to say, we want more support for these things.

The second thing I want to do is, who are the people that said they couldn’t do 2222 by 2030? I mean, we got to call them out, too. But before we do that, and thank you. I’m using a little comedy here, but really, we need to start naming names. And we need to start getting this job done because we can talk in broad strokes, and we can talk about why SMDs is not possible.

We can talk about why a unified FERC is not possible. But until we start calling out names and saying that is the party that’s got their thumb on the scale, let’s go find out why they or what they need to be satisfied, the carrots and the sticks.

Chairman Wellinghoff, the great 2222, 841, comments from you.

Jon Wellinghoff: Yes. No, I want to commend my friend and colleague, Chairman Chatterjee, for what he did in 841 and 2222, and I think he’s right. I agree with him. I think 2222 has the potential to be the greatest, impactful rule on carbon issues that FERC has ever issued. I mean, think about it this way. Just let me put it in a little context here quickly, for your listeners.

If, as projected by 2030, there are somewhere between 20 and 25 million electric vehicles on the roads in the US, the battery capacity in those electric vehicles will be more than the capacity in all the current electric generating stations in the United States. So, the potential for the utilization of those vehicles for, and as you alluded to it, at the beginning of the program, Jon, the cashback car, which is actually a term I coined, back in 2008, where ultimately, with a vehicle to grid connection, i. e., plugging in your car and charging it, while you’re charging it, you can actually provide grid services like regulation services to the grid, which we demonstrated in 2008 in the FERC driveway with an electric vehicle that we plugged in and which we had a PJM engineer there with his laptop signaling the car to provide regulation services to PJM , to PJM’s control room at the time. We demonstrated that there’s the potential there for monetary returns for consumers who have these vehicles that can use these for these purposes. And at that time, it was up to 7 to $10 per day, per vehicle that could be earned by ultimately providing these types of services.

So 2222 has great potential, but as Neil said, as Chairman Chatterjee said, the implementation is so important and it’s sort of, I want to throw a question back to Neil because I want to challenge him a little bit. Because on this SMD issue, I believe that SMD should apply to everything. SMD should apply to 2222. I believe that we need to implement 2222, but we need to implement it uniformly across the country. We cannot have different metering requirements for electric vehicles in New England than we have for electric vehicles in California to participate under 2222. Those standards need to be uniform under 2222, if we’re going to expect the automakers and others to be able to, and aggregators, to effectively participate under 2222.

So I would say that the place to start with SMD is Order 2222. And I think it’s actually doable there. If FERC could step up, it’s doable there.

Preventing Anti-competitive Practices and Advancing IDSOS

Neil: In fact, if I could just weigh in there, since Chairman Wellinghoff did ask me the question. Here’s where, for your listeners, Jon, this gets just incredibly interesting, complicated, frustrated, however you want to say it – all of the above.

So one of the reasons I think FERC currently has been reluctant to be more assertive on making sure that 2222 is implemented in the manner in which Chairman Wellinghoff weighs out, which I can strongly support of, is the focus on transmission. And right now, that is the primary focus of the commission right now is getting transmission reforms right. And it’s at the thrust of what we’re discussing here today. Fixing the broken interconnection queue process, getting a solution on citing, on cost allocation, on interregional planning, on putting competition into transmission. But all of this today is requiring a delicate balance between FERC and the states.

And as a result, right now, I think FERC is really, really reluctant to kind of push the envelope with the states. And in a weird way, I think it’s inhibiting the commission from doing what it wants to do on being more assertive on 2222 compliance implementation, the fact that they want to preserve the current D état with the states and not force something on the states that they’re reluctant to do so, at a time when they need maximum state cooperation on transmission.

So I’m not saying that Chairman Wellinghoff is not completely correct on SMD and on 2222. I think the obstacle is, interestingly, tied to transmission and what it will take to successfully get transmission reform done.

Jon: Or we could have FERC just become the master of all, and then they just do as they say. I mean, it seems to go back to the senate committee.

Neil: Easier said than done.

Jon: But Chairman Chaterjee, it seems to go back to this magical senate committee that the FERC commissioners answer to and have a little bit of fear about.

And if we can adjust that senate committee to represent more of the people’s interests, the energy users’ interests, we might have a situation that would be more tenable.

Great comments on both around SMDs and, of course, FERC 2222. Great acknowledgement of 841 as a predecessor and a real setting the stage for. Unfortunately, we hear at the CPU levels, what has been characterized as the declawing or defanging of 2022 happening sort of in real time, unfortunately.

And the next point around, prohibit anti-competitive behavior, was cited by both commissioners as something that we really need to get right. And the solution here is what? How do we prevent this type of behavior? Is it higher fees for people getting caught? Is it jail time, actual doing a perp walk? Or how do we make this stick?

Neil: I’ll start here. I have a more sympathetic view here. I don’t necessarily take the view that there are nefarious actors here trying to avoid competition. I take the more charitable view that I just think the incentives are misaligned. And to me, the answer here is finding a better way to incentivize the incumbents to embrace the opportunities and not look at the introduction of innovation as a threat to their monopolies. And this is something, quite frankly, that my staff and I wrestled with when we were putting together 2222.

There are several on my team who really felt as if we should structure the rule in a manner to better enable smaller, new entrants to come into the markets and compete. And I had others on my team say, Neil, if you really want to see the benefits of this rulemaking maximized in accelerated fashion, the key will be to find a way to make the big incumbent utilities incentivize to do it, and so they can make money off of it and profit from it and view it as an opportunity and not as a threat.

And so I like to take the more positive charitable view that if we could find a way to work with utilities to incentivize them and better properly align the incentive structure so that they want to avail themselves of these opportunities, rather than viewing them as a threat, I would like to try that.

Jon and I have worked on some matters together where we’ve been frustrated by the reaction that we have seen from some of the counterparties we have attempted to work with. I’m not going to name and shame. I’ll keep it very vague, but it is frustrating because I think there is a constructive conversation to be had here.

We just have to get stakeholders to the table, who are willing to compromise and understand that everyone can win here. And this doesn’t have to be some zero, some game, where there’s a winner and a loser.

Jon: Thank you, Chairman Chatterjee, for those ideas around prohibit the anti-competitive behavior side of things.

For the sake of Chairman Wellinghoff, shall we move to IDSOs, the distribution service operators?

Jon Wellinghoff: Sure. I’d be happy to. I wrote a paper. It must be now six or seven years ago, on this concept of an independent distribution system operator. And I was simply taking an analogy from what FERC had already done at the wholesale level, where FERC had enabled, through Order 888, 889 and the ability to create these independent system operators for the operation of the wholesale transmission system as an RTO/ISO, regional transmission operator, independent system operator, and as a market operator.

And taking that same concept down to the distribution level, especially to the extent that we have talked here. Commissioner, Chairman Chatterjee and yourself have talked about EVs and other distributed resources and the importance of those resources.

Those resources, first of all, live down at the distribution level. And they are going to become exceedingly important, not only to providing wholesale transmission level services, which in fact, they are doing now and capable of doing. Demand response and distributed generation and distributed storage are all serving and providing support to that wholesale market level, throughout the country and keeping the lights on.

But they will be able to do similar things at the distribution level, as well. And if we have then markets at a distribution level providing, inter consumer services between my house that has the solar system on its rooftop and Neil’s house across the street that needs some energy, having those kinds of transactions is going to require an independent operator. It’s going to require somebody independent from the distribution, monopoly wires provider. And they are not the one to be the proper party ultimately to provide that independent platform for those transactions.

Jon: I would also add, we’ve talked about EVs quite a bit, but I mean, we can also look at any HVAC system, whether it’s residential or commercial or industrial, as something that we can manage as a resource behind the meter and can really benefit the local distribution network tremendously.

Jon Wellinghoff: Truly any load that is behind the meter, I mean, think about your refrigerator’s defrost cycle. Do you care when your refrigerator freezer defrosts or not? You don’t. So if you can switch that in ways that it can benefit the grid and provide you with value, value back to you as a consumer, we should be able to enable that, enable it not only at the wholesale level, which we are doing now, but down at the distribution level. But to do that, you need an independent distribution system operator.

Jon: Yeah, peer-to-peer energy trading at the local level is quite compelling, especially with people that are investing in these assets.

Let me get Chairman Chatterjee’s thoughts on IDSO and the potential for a solution there.

Neil: I actually don’t have anything to add to what Chairman Wellinghoff laid out. He’s given a lot more thoughts to this than I have, and so I refer to his expertise and experience.

Jon: Great. Perfect. Perfect.

Well, I just want to summarize, as we’ve talked about six different ideas. First is competition. Second is a carbon price. The third is possibly having FERC everywhere, magically. How wonderful that would be. And we’re going to have to get that Senate committee call out. We’re going to develop the SMD world, around that unified market.

We’re going to have a fair and full implementation of Order 2022, the master stroke of Chairman Chatterjee, based on a lot of prior thought leadership by others including Chairman Wellinghoff. Anti-competitive behavior being punished. One of the suggestions there was, maybe we give incentives for the incumbents to move in this direction of DERs.

And then finally, really develop a market around independent distribution service operators, so that we can have a true peer-to-peer valuing of not only generation from renewables, but also load flexibility, delivered by behind the meter assets. This has been an absolutely incredible session together.

I want to give Ted Thomas a chance to chime in if he has any questions for either the chairmen. Or if not, we can just conclude and put a top on this and hopefully do another session, in the future. Ted?

All right. Ted doesn’t have anything more to say.

Ted: I’m good.

Jon: Oh, there he is.

Ted: Yeah, I’m good. I enjoyed this conversation. I don’t have any questions.

Jon: Fantastic. Thank you, Ted, for your prior contributions to session 101 and 201, and we encourage people to watch those. We’re going to have these slides down below in the show notes so everyone can share them amongst their friends.

I want to give great thanks to both Chairman Wellinghoff and Chairman Chatterjee, and of course, Ted Thomas for his long commitment to this idea of educating everyone around these really important issues of interconnecting and fair operation, of renewable, behind the meter assets, and distributed energy resources.

Thanks everyone and talk to you soon.

All right, we’re going to break that down, and we’ll edit out the back bit. Thank you all for doing this session together. It was a lot of fun, and we might even have further communication around next steps, but I know you’ve all got to go. And thanks again.

Jon Wellinghoff: Thank you, Jon.